It was a relatively short list of property tax appeals for the Petersburg borough this year. The borough assembly acting as the Board of Equalization Monday ruled on four disputed property assessments. One of the disputes was over an assessment on mining claims in the borough.

Audio Player

There were over 200 appeals last year, in the first year of property tax in the new borough outside of the old city limits. This year the borough had 66 appeals. By Monday’s hearing, all but four were resolved by the borough’s assessor meeting will appellants and coming to an agreement over proposed tax assessements.

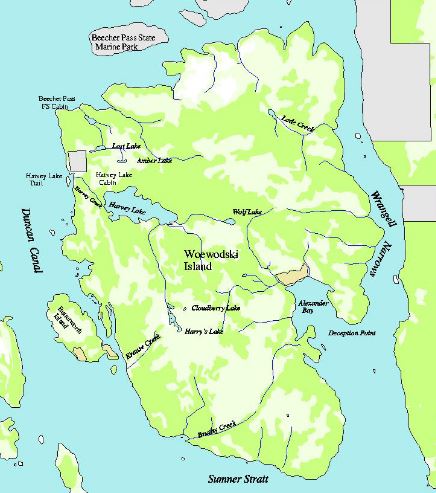

One of the appeals that was not yet resolved centered around mining claims on federal lands on Woewodski Island on the southern end of the borough. The borough’s assessor valued the claims at 18-thousand 700 dollars. However, Phil Beardslee of Olympic Resources, the company that holds the claims, contested the borough’s right to tax those mining rights. He attended the meeting by phone and said his company already paid for the right through the Bureau of Land Management. “My dealings are with the BLM, that’s who I pay a maintenance fee to every year,” Beardslee said. “We pay about 3,600 dollars every year for 23 claims. And to turn around and start paying the city for something that the state has no right to tax, is completely wrong.”

The claims are on national forest land and the company files a plan with the U.S. Forest Service to explore for precious metals there. Beardslee said Olympic Resources did not have any buildings on the land, only an exploratory drill platform, about five by ten feet. Beardslee threatened a class action lawsuit over the tax and thought the borough would be discouraging mine projects. “What you guys stand to lose in economic develop out of all of this is a heck of a lot bigger than any amount you’re gonna get from me in paying taxes on it. You think about what’s in the best interest of the borough and the people in the Petersburg area,” he said.

Meanwhile, an email from the state assessor asserted the borough could tax mining claims saying the claim holder had a “private ownership interest in a limited set of rights in the property.”

Arne Erickson of the Appraisal Company of Alaska, the company hired by the borough, compared mining claims to a lease. Erickson said it gave the claim owner temporary rights to the land that others do not have. “And like any governmental entity that’s exempt from taxation be the state government, municipal government, federal government, if you have a use of the land for a period of time, you are taxed on that possession,” Erickson said. “And we rely on the state law as the state assessor has provided it, title 29, as the authority on which to do it.”

The assembly members who act as Petersburg’s board of equalization were not ready to get into a discussion on whether the borough should tax mining claims. Jeigh Stanton Gregor sounded interested in having that discussion at a later date. “I find Mr Beardslee’s arguments compelling in the broader spectrum but in the context of us as the Board of Equalization I feel our mandate is clear to approve the assessor’s valuation. And I more or less look forward to investigating this further down the line because I think it’s a broader question then we can address here.”

The Board of Equalization voted 7-0 to uphold the assessors valuation on the mining claims. The vote was also unanimous to uphold the assessor’s other recommendations on three other appeals.